Singapore's Leading Debt Consultant with EDUdebt: Customized Solutions for Debt Administration

Singapore's Leading Debt Consultant with EDUdebt: Customized Solutions for Debt Administration

Blog Article

Open the Conveniences of Engaging Debt Expert Services to Browse Your Path Towards Debt Alleviation and Financial Liberty

Involving the services of a debt specialist can be a pivotal action in your journey towards attaining financial obligation relief and economic stability. The concern stays: what certain benefits can a financial obligation expert bring to your monetary scenario, and exactly how can you identify the best partner in this endeavor?

Recognizing Financial Debt Professional Services

Just how can financial obligation professional solutions transform your financial landscape? Debt professional services offer specialized support for individuals coming to grips with economic challenges. These specialists are educated to assess your financial circumstance thoroughly, providing customized strategies that align with your one-of-a-kind conditions. By assessing your revenue, financial obligations, and expenses, a financial obligation professional can help you identify the origin causes of your economic distress, enabling a more precise approach to resolution.

Financial debt consultants normally employ a multi-faceted strategy, which may include budgeting help, arrangement with creditors, and the advancement of a calculated payment strategy. They serve as middlemans between you and your financial institutions, leveraging their proficiency to discuss much more positive terms, such as decreased interest prices or extensive settlement timelines.

Additionally, financial debt consultants are equipped with updated understanding of appropriate legislations and guidelines, ensuring that you are notified of your rights and choices. This specialist support not just alleviates the psychological worry connected with debt but likewise empowers you with the devices required to reclaim control of your economic future. Ultimately, engaging with financial debt consultant solutions can lead to an extra educated and organized path toward economic security.

Trick Advantages of Specialist Support

Engaging with financial debt specialist services provides countless benefits that can dramatically improve your monetary situation. Among the primary advantages is the knowledge that specialists give the table. Their extensive knowledge of financial obligation monitoring strategies enables them to customize options that fit your one-of-a-kind circumstances, making certain a more effective technique to accomplishing monetary stability.

In addition, financial debt consultants commonly offer settlement support with financial institutions. Their experience can cause much more desirable terms, such as decreased rate of interest or resolved financial debts, which may not be attainable through direct arrangement. This can result in considerable economic alleviation.

Moreover, professionals offer an organized prepare for repayment, helping you focus on debts and allocate resources successfully. This not just streamlines the payment procedure yet also promotes a sense of liability and progress.

Eventually, the mix of specialist assistance, settlement abilities, structured payment strategies, and psychological support settings financial obligation experts as useful allies in the quest of financial obligation alleviation and financial flexibility.

Just How to Pick the Right Professional

When picking the right debt consultant, what crucial aspects should you take into consideration to guarantee a favorable outcome? First, examine the consultant's certifications and experience. debt consultant services singapore. Look for qualifications from acknowledged companies, as these indicate a level of professionalism and knowledge in financial obligation management

Following, take into consideration the professional's track record. Research on the internet reviews, testimonials, and scores to determine previous clients' complete satisfaction. A strong performance history of effective financial obligation resolution is vital.

Additionally, evaluate the professional's method to debt monitoring. A good specialist needs to provide individualized solutions customized to your unique financial circumstance as opposed to a Click This Link one-size-fits-all option - debt consultant services singapore. Transparency in their costs and processes is essential; ensure you comprehend the prices involved before committing

Interaction is an additional essential element. Choose a professional who is friendly and prepared to address your questions, as a solid working relationship can improve your experience.

Usual Financial Obligation Relief Approaches

While various financial debt alleviation methods exist, selecting the best one relies on individual economic conditions and objectives. Some of the most common approaches include financial obligation loan consolidation, debt management strategies, and financial obligation settlement.

Debt combination entails integrating multiple debts right into a single car loan with a reduced rate of interest rate. This approach streamlines settlements and can minimize month-to-month obligations, making it easier for individuals to reclaim control of their finances.

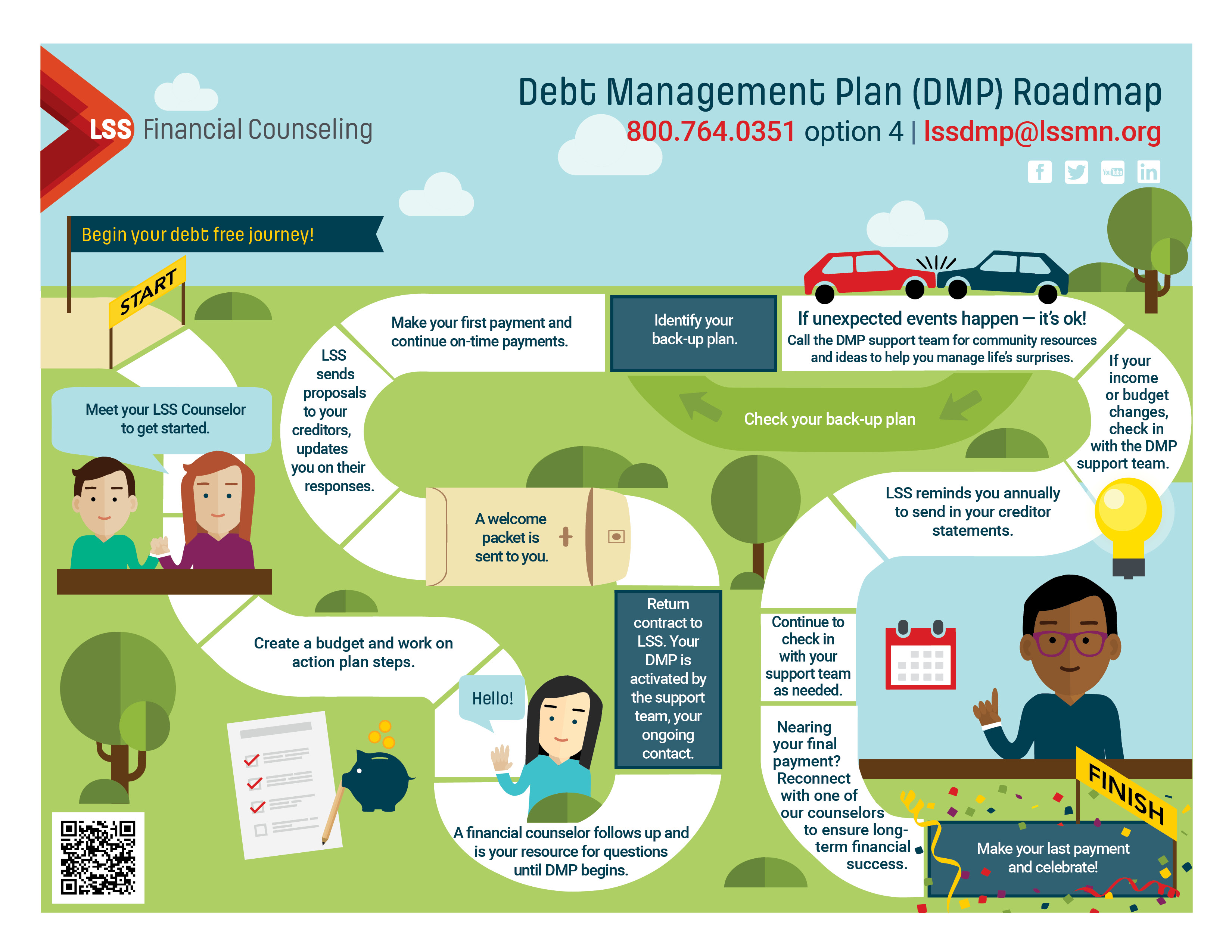

Financial obligation monitoring plans (DMPs) are made by credit scores therapy companies. They bargain with creditors to lower rate of interest and develop an organized repayment strategy. This choice permits individuals to settle financial obligations over a fixed duration while taking advantage of expert guidance.

Debt settlement entails working out straight with lenders to clear up financial obligations for much less than the complete quantity owed. While this method can give instant relief, it might affect credit history and often entails a lump-sum settlement.

Last but not least, bankruptcy is a legal alternative that can provide remedy for overwhelming financial obligations. Nevertheless, it has lasting monetary implications and should be thought about as a last hope.

Selecting the proper strategy requires cautious evaluation of one's monetary scenario, making certain a customized method to attaining long-lasting security.

Steps In The Direction Of Financial Liberty

Following, develop a reasonable budget plan that prioritizes basics and fosters savings. This budget should consist of arrangements for financial obligation repayment, allowing you to assign surplus funds properly. Adhering to a budget assists grow self-displined costs routines.

When a spending plan is in place, consider engaging a financial obligation specialist. These professionals provide tailored methods for managing and reducing debt, offering understandings that can expedite your trip toward monetary freedom. They might suggest choices such as financial obligation consolidation or settlement with lenders.

Additionally, focus on developing an emergency fund, which can avoid future monetary pressure and supply tranquility of mind. Together, these actions create a structured method to accomplishing economic flexibility, transforming ambitions right into reality.

Verdict

Engaging financial obligation professional solutions provides a calculated approach to achieving debt relief and economic freedom. Inevitably, the experience of debt consultants considerably boosts the possibility of navigating the complexities of financial debt administration successfully, leading to a much more protected financial future.

Involving the solutions of a financial obligation consultant can be a critical action in your journey in the direction of attaining financial debt relief and financial stability. Financial debt professional solutions offer specialized guidance for individuals grappling with monetary challenges. By analyzing your earnings, useful link financial debts, and expenditures, a debt specialist can assist you recognize the origin triggers of your financial distress, permitting for an extra accurate strategy to resolution.

Involving debt consultant services offers a strategic strategy to accomplishing financial obligation relief and monetary liberty. Inevitably, the experience of debt experts substantially improves the likelihood of navigating the complexities of financial obligation administration effectively, leading to a much more safe and secure financial future.

Report this page